Our Strategy

GROUP STRATEGY

The objective of our strategy is to deliver long-term value to shareholders, outstanding service to customers and rewarding careers to our employees by being the leading global provider of temporary power and temperature control. Our strategy is founded on the belief that, in our market sector, it is possible to create competitive advantage by building a truly global business; one which operates in the same way around the world and can use the same fleet everywhere, the same processes, the same skills and the same infrastructure. This homogeneity means that significant operating advantages and efficiencies accrue to those who have global scale; the focus of our efforts, is therefore directed towards building global scale and securing these advantages and efficiencies for ourselves.

Our current strategy was developed following an in-depth review of Aggreko's business in 2003, and we have worked relentlessly to implement it, with the occasional tweak on the tiller, for the last ten years. We believe that this consistency of purpose has been a major contributor to our success and that the result – 17% compound growth in revenues and 24% compound growth in trading profit over ten years – is proof of the strategy's success.

|

Aggreko Group |

|||

|

2013 |

2003 |

CAGR |

|

|

Revenue (£m)1 |

1,531 |

324 |

17% |

|

Trading profit (£m)1 |

354 |

42 |

24% |

|

Trading margin1 |

23% |

13% |

|

|

Diluted earnings per share (pence) |

92.03 |

10.14 |

25% |

|

Return on capital employed (ROCE)2 |

21% |

13% |

|

|

Enterprise value at year end (£m)3 |

4,961 |

514 |

25% |

|

1 Excluding pass-through fuel. 2 Calculated by dividing operating profit for a period by the average net operating assets as at 1 January, 30 June and 31 December. The Definition and calculation of Non GAAP measures section explains this in more detail. 3 Enterprise value is defined as market value plus net debt. The Definition and calculation of Non GAAP measures section explains this in more detail. |

|||

By the measure of delivering long-term growth, the performance of Aggreko over the last ten years has been exceptional; few businesses of our size have been able to deliver 25% compound growth in earnings over a decade. Whilst it is tempting to see this solely as the result of our own hard work, the fact is that we know we stand on the shoulders of giants. Aggreko's success over the last decade has been made possible by the skilful and patient investment made over the previous forty years by our predecessors. It was they who built a network of service centres in North America, Europe and Australia; understood that designing and building our own equipment had major advantages; created a hard-working, entrepreneurial and customer-focused culture; and built a brand. The lesson we see every day is that it takes decades to achieve the sort of global scale which Aggreko now enjoys, and there are no short cuts.

We have a policy of thoroughly reviewing our strategy every five years, with interim updates every two years; following the first strategy review being presented to investors in 2004, we completed major reviews and presented them to investors in 2008 and, most recently, in 2013. Aggreko's strategy is developed by the senior management team, led by the Chief Executive, and involves internal and external research, much of it proprietary. We seek to develop a deep understanding of the drivers of demand, changing customer requirements, and the competitive environment as well as developments in technology and regulation. We look at our own strengths and weaknesses, and at the opportunities and threats that are likely to face us. From this analysis, we develop a list of investment and operational options and analyse their relative risks and rewards, bearing in mind the capabilities and resources of the Group.

In 2012 we completed our latest strategy review and presented it to investors in March 2013. In the review we first examined how we had performed against the five-year targets we had set ourselves in 2008, as part of the previous Strategy Review. The answer was pleasing:

- At the 2008 review, we said we would aim to grow revenues over the 5 years to 2012 at double-digit rates; in the event, revenues increased 2.4 times over the period, and grew at a compound average rate of 20%.

- We said that we expected some margin dilution as the volume of Military contracts reduced. These contracts ran longer than we expected, and we benefited from a major 'black swan' event in the form of contracts arising from the Fukushima disaster in Japan. As a result trading margin increased by 4 percentage points; trading profit almost tripled, growing at a compound rate of 24%.

- We said that we would focus investment in our Local business on growing in emerging markets, which we expected would allow us to grow faster than developed market growth of GDP +2-3%. During the period, Local business revenues grew at a compound rate of 13%, excluding the impact of major events, and 15% including major events.

- We said that we believed that the market for Power Projects would grow at around 20% per annum, and that our business would grow its revenues at that rate +/–5%. In the event our Power Projects revenue, excluding pass-through fuel, grew at a compound rate of 29%.

- We said that we believed our anticipated growth would require us to invest around £1 billion on new fleet and that we would be able to do that without recourse to shareholders. Our growth was much faster than we anticipated, and the required fleet investment much larger, at £1.5 billion. Not only did we finance this all ourselves, we were able to return over £350 million to shareholders over the period through ordinary dividends and in 2011 a £149 million cash return to shareholders.

The net result of this for shareholders was that between 2008 and 2012, Aggreko delivered a Total Shareholder Return of 247%, which compared with the FTSE 100 return of 11% over the period. However, just as pleasing to the managers of the business was the operational performance. We rapidly expanded the reach of the business, opening or acquiring 73 new locations; we successfully completed and integrated five acquisitions; we invested millions of pounds in developing new engine technology which in 2013 allowed us to launch our G3+ and G3+ HFO engines (of which more anon). We grew our gas fleet to over 1,300MW of capacity, of which over 1,000MW was on rent by the end of 2012. And most important, despite having more than doubled revenues and nearly tripled profits, we did not irritate our customers while doing it. To the contrary, over the period our Net Promoter Score, which measures customer satisfaction, increased by ten percentage points from an already extremely high level.

It was not all plain sailing, however. We had thought there would be an opportunity to grow a business in Europe providing 'balancing services', which would help national grids manage the expected rapid growth of wind-power; despite trying hard, we could not figure out a way we could make money doing this, so gave up on the idea. We also wanted to grow our temperature control business; we failed, and revenues for this product line stayed stubbornly flat. Finally, the results would have been even better if we had not had to increase bad debt provisions in our Power Projects business and thereby reduce profits by some $78 million over the period mainly due to our inability to persuade a few large customers to pay their bills on time.

The main focus of the Strategy Review was of course planning for the next five years, and as part of every five-year review we try to look at the business at a fairly fundamental level. Are we in the right markets with the right products? Do we have an appropriate structure and management team? Once we have looked at these fundamental issues, we then go on to explore business line strategies.

On a fundamental level, our conclusions were:

Are we in the right markets with the right products? We are active in around 100 countries in the world, so we do not think we are lacking reach. In terms of product offering, we concluded that our strategy of remaining focused on two product ranges – power and temperature control – remains correct. Whilst we reserve the right to revisit this, and will stay alert to new opportunities, we believe we have ample opportunities for growth within the existing portfolio, and suspect that trying to push new types of product through our channel would only create confusion and dilute focus. However, within power and temperature control, we have significantly improved our ability to develop product and optimise it to our own requirements; we think this is a powerful differentiator, and intend to continue to invest heavily in this work.

We looked at our organisational structure as part of the Strategy Review, and concluded that, after ten years our old structure of having three regions – Europe, North America, and 'Aggreko International' (basically, everywhere else) – was no longer right. Two thirds of our profits came from Aggreko International, and the management of that region were finding it increasingly hard to exercise the oversight and control necessary when the region was so large and complex. We therefore re-organised the business, keeping three units, but having each responsible for a logical and contiguous geography: Asia-Pacific, Europe Middle East & Africa, and the Americas. This new structure is performing very well, specifically, we are getting much better co-operation between Local and Power Projects operations within regions; oversight is stronger; and management are closer to their businesses and are not constantly jetlagged as all their business is within similar time-zones.

An important consideration on structure relates to defining our business as having two lines: the 'Local' business, and the 'Power Projects' business. We describe these two business lines in more detail below and in the 'What We Do' section, but in short, the Local business handles day-to-day transactional rentals to industrial and commercial customers, whilst Power Projects owns and operates temporary power plants, selling kilowatt-hours principally to utilities in emerging markets. The two businesses share fleet and resources, but the customer requirements tend to be different, and, historically these two business lines have operated in different geographies, with the Local business being focused on Europe and North America and other developed economies, whilst Power Projects operated almost exclusively in emerging markets. In our 2008 Strategy Review, we identified that we wanted to grow our Local business in emerging markets, and as we have executed on this plan the business segments began to cross paths more often; both the Local business and the Power Projects sales teams were coming across opportunities where the question was asked – is this a Power Project or a Local business contract? From this we identified the need to focus during the next strategy cycle on 'mini-projects', which we describe in more detail under the Local business strategy below.

At a Group level, the targets we have set ourselves for the period 2013-2017 are that we expect to be able to achieve, on average and with year-on-year variation, underlying (which in this case is adjusted for the impact of the known decline in Military and Japanese contracts, London Olympics, Poit Energia, passthrough fuel and currency) revenue growth of over 10%, with trading margins and returns on capital employed of over 20%. In 2013 underlying revenue growth was below the target range at 6%, whilst margins at 22% and return on capital employed at 21% were both within the range. The principal reason for undershooting the revenue target was because of challenging conditions in the Power Projects market, as set out below and in the Trading Review. We are not inclined to change our revenue target, as we regard it as an average to be achieved over a five-year period, and we would expect there to be year-on-year variation. It is worth noting that at the start of our last strategy review period we were beset by the impact of the global financial crisis of 2008-2009, but managed to survive that and went on to beat our five-year targets.

Having looked at the fundamentals of our Group strategy, we then moved on to set out the strategies for both the Local and Power Projects business lines.

LOCAL BUSINESS STRATEGY

The Local business serves customers from 202 service centres and offices in 49 countries in North and Latin America, Europe, the Middle East, Africa, Asia and Australasia, with eight (net of closures) new locations added during 2013. This is a business with high transaction volumes: an average contract (outside of major events) lasts for a few weeks and will be worth less than £20,000. The Local business represents 59% of Aggreko's revenues, excluding pass-through fuel, and 45% of trading profit. Since our first strategy review in 2003, revenues and trading profit have increased at a compound growth rate of 13% and 19% respectively:

|

Aggreko Local business |

|||||

|

% of Group |

|||||

|

2013 |

2003 |

CAGR |

2013 |

2003 |

|

|

Revenue (£m) |

904 |

258 |

13% |

59% |

80% |

|

Trading profit (£m) |

158 |

27 |

19% |

45% |

64% |

|

Trading margin |

18% |

10% |

|||

|

ROCE2 |

17% |

11% |

|||

Following our Strategy Review, we believe that our Local business will continue to offer attractive opportunities for growth, particularly in emerging markets. We believe that the underlying market for power and temperature control rental tends to grow at around 2 times GDP. We have been investing in expanding our Local business in emerging markets because their GDP is growing faster, and markets growing at twice GDP growth of 6% are more attractive than markets growing twice GDP growth of 2%.

There are three elements to our operational strategy for the Local business:

- Maintain a clear differentiation between our offering and that of our competitors by providing outstanding customer service and a high-quality rental fleet.

- Use the benefits of global scale to be extremely efficient. This should enable us to make attractive returns whilst delivering a superior service at competitive prices.

- Offering superior service at competitive prices will allow us to increase market share and extend our global reach, delivering growing revenues at attractive margins. In terms of markets we serve, we will continue to be focused on expanding our presence in countries that have high rates of GDP growth, particularly emerging markets. This enables us to obtain higher levels of growth, and increase our scale and global reach.

Against the first objective – to maintain a clear differentiation between our offering and that of our competitors – third-party research shows that Aggreko is one of the world's best-performing companies in terms of customer satisfaction. We are determined to maintain this reputation for premium service and we do this through the attitude and expertise of our staff, the geographic reach of our operations, the design, availability and reliability of our equipment, and the ability to respond to our customers 24 hours a day, 7 days a week.

The claim to be one of the world's best-performing companies in terms of customer satisfaction is a big one, but we think we have good reason to make it. For each of the last five years we have been asking about 20,000 customers what they think of the service they have received from us, and we measure our Net Promoter Score. This is an objective measure of customer satisfaction which reflects the balance between those who think we are wonderful and those who think we are dreadful. Happily, the former greatly outnumber the latter. Over the last five years our score has improved by six percentage points and Satmetrix, a global leader in customer experience programmes who manage over 21 million customer responses annually (including Aggreko's), have confirmed that our Net Promoter Score in 2013 was amongst the top quartile of all the companies benchmarked worldwide in the business-to-business segment.

We have also focused on improving the operational performance of equipment; one of the reasons why our Net Promoter Score has increased so markedly is that we have radically reduced the number of breakdowns our customers experience. Aggreko equipment has always been widely regarded as the highest quality in the industry, but in recent years we have worked hard to improve this reputation further, and since 2007 we have doubled the number of days a customer can expect to use one of our generators without a failure.

The second objective of our strategy for the Local business is to be extremely efficient in the way we run our operations. This is essential if we are to provide superior customer service at a competitive price and, at the same time, deliver to our shareholders an attractive return on capital. In a business in which lead-times are short, logistics are complex and we process a large number of low-value transactions, a pre-condition of efficiency is having high-quality systems and robust processes.

The operation of our Local businesses in most areas is based on a 'hub-and-spoke' model which has two types of service centre: hubs hold our larger items of equipment as well as providing service and repair facilities; spokes are smaller and act as logistics points from which equipment can be delivered quickly to a customer's site. The hubs and spokes have been organised into areas in which a manager has responsibility for the revenues, profitability and the return on capital employed within that area. In this model, most administrative and call handling functions are carried out in central rental centres.

Our Local business enjoys numerous advantages as a result of its global scale. Standardised operating processes and a world-class IT platform bring visibility and homogeneity. Global utilisation statistics allow us to spot where equipment is under-utilised and where it can be moved to for the best return, and this is reflected in the increase in sales/gross rental assets which is a financial measure of utilisation; between 2003 and 2013, sales/gross rental assets in the Local business increased from 62% to 72%. Building our own equipment allows us to stock our fleet with premium-quality equipment at a competitive cost. Global reach allows us to deliver service to customers (such as major events customers) wherever they go. Global processes allow us to disseminate best practice quickly. The benefits of our global scale accrue to both customers and shareholders. Our Net Promoter Scores tell us that the model works well for customers and, for our shareholders, the benefit has been a compound growth in trading profit of 19% over the last 10 years and a return on capital employed that has improved from 11% to 17% over the same period.

Some people ask us why the return on capital in the Local business is lower than in Power Projects; the answer to this is that, inherently, the risks – political, economic and people-related (refer to the Principal risks and uncertainties section) – we run in the Local business are far lower than in Power Projects and, therefore, the rewards are consequently (and properly) lower.

The third objective of our strategy for the Local business is to deliver growth in revenues by increasing market share and global reach. In our more mature markets, such as North America and Europe, we know that the most profitable businesses are those where we have dense networks of service centres which can share equipment, staff and customers, and benefit from the low transport costs that come from being physically close to customers. So, in these markets, we focus on adding new service centres and upgrading existing centres to make them more capable. In the last 5 years, in our mature markets in Australia/New Zealand, North America and Europe, we have opened or upgraded service centres and offices, including those acquired as part of an acquisition in:

Americas mature markets: Edmonton, Fort McMurray, Ft St John, Gillette, Indianapolis, Long Island, Minneapolis St Paul, Minot, Odessa, Pittsburgh, Roosevelt, Saskatoon, Seattle, Three Rivers

EMEA mature markets: Padova, Staphorst

APAC mature markets: Christchurch, Geraldton, Gladstone, Muswellbrook, Mt Isa, New Plymouth, Surat Basin, Tauranga, Wellington, Wollongong

However, we know that our businesses grow fastest where there is strong growth in GDP. So a core part of our strategy has been expanding our Local business in the faster-growing economies of Latin America, the Middle East, Africa and Asia. In the last 5 years, we have opened or upgraded service centres and offices in:

Americas faster-growing economies: Belem, Ciudad del Carmen, Monterrey, Panama, Tampico, Villahermosa, Belo Horizonte, Boa Vista, Bogota, Brasilia, Buenos Aires, Camacari, Campo Grande, Concepcion, Copiapo, Cordoba, Cuiaba, Florianopolis, Goiania, Guadalajara, Hermosillo, Lima, Neuquen, Parauapebas, Porto Alegre, Recife, Sao Bernardo, Sao Luiz, Sao Matteus, Tucuman

EMEA faster-growing economies: Baku, Bucharest, Cape Town, Durban, Johannesburg, Istanbul, Jubail, Walvis Bay, Moscow, Nairobi, Port Elizabeth, Riyadh, Warsaw

APAC faster-growing economies: Bangkok, Chennai, Dalian, Foshan, Ho Chi Minh City, Hyderabab, Kolkata, Manila, New Delhi, Pune, Seoul, Tokyo, Vizag

The latest strategy review identified that as we expand the Local business into territories that were previously only served by Power Projects we are seeing opportunities to perform smaller power projects through the Local business. This has numerous advantages; the logistics of selling and executing a 15MW project in, say, Manaus, are significantly easier if managed from our Manaus service centre, rather than from the Power Projects hub in Panama or Dubai; it adds scale to the Local business; and it strengthens Local business capability and reputation. Furthermore, it expands our addressable market; as discussed in the 'What We Do' section, utilities are frequently short of funds and are sometimes neither motivated nor able to spend millions of pounds solving power shortages. Industrial users, however, feel the pain of power cuts very directly, and the cost of sourcing additional power to maintain production can easily be justified. In this respect, we are excited by the opportunity to address the structural problem of power shortages in emerging markets from two directions – Power Projects addresses the large-scale power provider (i.e. utility) market, whilst the Local business addresses the problem from the power users' (i.e. commercial and industrial) point of view. We are therefore encouraging our Local businesses in emerging markets to address this segment of the market, which we call 'mini-projects', and so far this is showing excellent results. As at the end of 2013, we had over 260MW on rent in mini-projects (defined as contracts for over 12MW and for more than three months duration) in the Local business, which was over 75% higher than at the end of 2012.

The one disadvantage of this approach is that to outside observers, comparing our performance with competitors who only have Power Projects business, it may appear that our growth in power projects is slower than it is in fact, as contracts are increasingly performed by the Local business. We cannot see a clever way round this, other than letting the numbers speak for themselves.

LOCAL BUSINESS PERFORMANCE

In terms of our expectation of the rates of growth the Local business will deliver over the five years from 2013, we expected underlying (excluding London Olympics, Poit Energia acquisition and currency) revenue growth of between 8% and 12%; margins of between 17% and 20%; and a return on capital employed of between 18% and 21%. It should be emphasised that these are the averages we would expect over a five year period, and there will be years when we may be outside one of these ranges with 2013 being an example of that.

In 2013, our Local business performed well, albeit fractionally outside these ranges: on an underlying basis revenues grew by 7%, against a target of 8-12%; trading margin was within our target range at 18%; return on capital employed was just outside target range at 17%, against a target of 18-21%.

POWER PROJECTS STRATEGY

This business serves the requirements of power utilities, governments, armed forces and major industrial users for utility-quality, temporary power generation. Whereas in the Local business we rent equipment to customers who operate it for themselves, in the Power Projects business we contract to provide electricity generated by plants that we own, build, commission and operate. We are seen as a power producer, not a renter of equipment. The power plants can range in size from 10MW to 250MW on a single site.

Most often, the business operates in areas where we do not have a large Local business. The majority of the customers are power utilities in Africa, Asia and Latin America. As described in the 'What We Do' section, the driver of demand in these markets is that our customers' economies are growing, with consequent increases in demand for additional power which cannot be met by the current generating capacity. As a result, many of our customers face chronic power shortages which damage their ability to support economic growth and increased prosperity. These shortages are often caused or exacerbated by the variability of supply arising from the use of hydroelectric power plants whose output is cyclical and dependent on rainfall.

Power Projects now represents 41% of Group revenues and 55% of trading profit, excluding pass-through fuel. Since 2003, Power Projects revenue excluding passthrough fuel and trading profit have grown at a compound annual growth rate of 25% and 29% respectively

|

Power Projects |

|||||

|

% of Group |

|||||

|

2013 |

2003 |

CAGR |

2013 |

2003 |

|

|

Revenue (£m)1 |

627 |

66 |

25% |

41% |

20% |

|

Trading profit (£m)1 |

196 |

15 |

29% |

55% |

36% |

|

Trading margin1 |

31% |

23% |

|||

|

ROCE2 |

27% |

25% |

|||

|

Note: pass-through fuel refers to revenues we generate from three customers for whom we have agreed to manage the provision of fuel on a ‘pass-through' basis. This revenue stream fluctuates with the cost of fuel and the volumes taken, while having an immaterial impact on our profitability. We therefore exclude pass-through fuel from most discussions of our business. |

|||||

Our Power Projects business is focused on emerging markets where growth is driven by structural issues. Demand for electricity in emerging markets is growing faster than GDP, and few countries have been able to finance the additional permanent generating and transmission capacity needed to keep up with demand. Our review confirmed that these structural issues are likely to remain in place for the foreseeable future; we believe that the shortfall between supply and demand will grow at about 13% CAGR for the five years from 2013. We think that this will translate into an increase in market demand for temporary power in the range of 10-15% per annum, on average, and depending on year-to-year variation.

The strategy for the Power Projects business is straightforward, and remains as it has been for the last ten years: grow as fast as we prudently can, to secure for ourselves the operating efficiencies and competitive advantages which come from being the largest global operator. So far, we have been successful in executing this strategy and our Power Projects business is now many times larger than its next largest competitor.

The reason why it is advantageous to be a global operator in Power Projects is because demand can shift rapidly between continents. In 2003, Latin America and Asia were probably the largest markets, and Africa was only a small proportion of global demand. In 2009, the market in Africa was larger than Latin America and Asia combined. In the last couple of years, the position (as measured by our fleet-onrent) has become more balanced with the current weighting more towards Africa. These shifts in demand were driven in part by rainfall patterns, which affects the output of hydro power plants, in part by the relationship between economic growth and investment in permanent power generation and, in part, by geo-political and economic issues. To be successful in the long-term, therefore, requires the ability to serve demand globally, and that requires sales, marketing and operational infrastructure to be present in all major markets.

The reason we want to be big – and bigger than any of our competitors – is because we believe that, as in the Local business, scale brings significant competitive advantages in Power Projects. There are numerous reasons for this:

- Being able to address demand on a worldwide basis means higher utilisation. When fleet returns from a customer at the end of a contract, the speed with which it can be put back on contract again is a major determinant of profitability and returns on capital. Fleet will find new work far more quickly if it can address the total pool of world demand than if it is only able to operate in a single region.

By the time customers have decided they really do have to spend money on temporary power, they generally want it as fast as possible. Being able to offer very fast delivery of large amounts of generating capacity is a significant competitive advantage. Small operators cannot afford to keep 250-300MW of capacity (say, £30-£40 million of capital) sitting idle waiting for the next job. Because the equipment used in Power Projects is also used in the Local business fleet, we manage our large generators as a common global pool across all our regions. Between the Local business and Power Projects, we currently have a fleet of over 7,100 of these large generators, and can deploy hundreds of MW of capacity from our various businesses around the world on very short notice. A good example of our speed of delivery would be the first phase of the power contract in Mozambique where, in response to a power shortage, we were able to deliver and commission over 100MW within 18 weeks of contract signature despite the fact that this involved us building a substation, transmission lines, gas pipeline and a road to access the site.

- The management of risk is a critical part of our business; we place tens of millions of pounds worth of capital assets in countries where the operational, political and payment risks are high – sometimes very high (refer to the Principal risks and uncertainties section). While we take great care to mitigate these risks, it is probable that sooner or later we will have a loss of either receivables or equipment, or both. However, because of our scale, such a loss would not imperil the Group as a whole. We treat our risks in the same way investors do: we minimise the risk of losses doing material damage to the business by having a broad portfolio of exposures, none of them correlated. For smaller companies, their portfolio of country risk is inevitably much more concentrated; the probability of loss in any one country for smaller companies is no less than it is for us, but their ability to withstand the consequences of a large loss is. Scale therefore allows us to deal in markets where others might, with good reason, fear to tread.

- Returns from rental businesses are heavily dependent upon the underlying capital cost of the rental fleet. Clearly, large buyers should get better terms than small buyers and, since we are by far the largest purchaser of power generation for rental applications in the world, we believe that we are advantaged in this area, and we estimate that our capital cost/MW is typically 20-40% lower than competitors'. The fact that we have the scale to justify having our own manufacturing and design facilities also means that we can source equipment which is better suited to our precise requirements, and at lower cost, than smaller operators.

In summary, a large operator will have lower volatility of demand, better lifetime utilisation of equipment, be better able to respond to customer requirements, and will have a lower capital cost per MW of fleet. In Power Projects, bigger is better – and Aggreko is now much larger than any other competitor in this market.

To be able to sustain a position of being the largest player in the market also requires us to have marketleading products, and to be able to offer customers the best value in the market. Our strategy review highlighted the importance of cost to our customers; temporary power is widely regarded as being expensive, but that is almost exclusively a function of fuel cost, which can be as much as 10 times the cost of the equipment rental charge. Historically, temporary power plants have been fuelled by diesel, which has the advantage of being readily available almost everywhere in the world. However, it is extremely expensive compared to the fuels permanent power plants use – typically coal, gas or HFO; dieselfuelled temporary power might cost a utility $0.25 per kilowatt hour, but of that amount only $0.03 might be the actual cost of the generation; the balance of $0.22 will be fuel. Permanent plants running gas or HFO would typically have a fuel-inclusive cost of $0.10- $0.15 per kilowatt hour, depending on fuel type and plant efficiency. We believe that if we can make temporary power cost-competitive with permanent power, the market will expand considerably, particularly since temporary power plants are much more flexible than permanent capacity, which typically has to be contracted for 20-year periods.

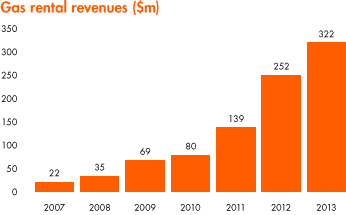

We have therefore been investing heavily in the development of temporary power generation that can use gas and Heavy Fuel Oil. We were the first company to develop and produce in volume 1MW gas-fired generators in 20 foot containers, and we now have over 900MW on rent in our Power Projects business – far ahead of any competitor; in the second half of 2013, gas-fuelled plant generated 35% of our Power Projects rental revenue, having grown at a compound growth rate of over 55% between 2007 and 2013. Utilities using our gas technology are enjoying all-in costs per kilowatt-hour from our plants which is often cheaper than some of their permanent capacity, and far below diesel-fuelled power plants.

Gas, however, has one major disadvantage, which is availability. Gas supplies tend to be contracted years ahead, and finding a combination of a customer who wants temporary power, who has gas supplies available, and a pipeline that intersects the grid at a point we can interconnect is tricky. Typically, the gestation period for gas-fuelled temporary power contracts is much longer than for diesel contracts because of fuel availability.

In 2010 we began to explore if we could find a 'middle way'; a fuel that was cheaper than diesel, but more easily available than gas. The answer was HFO, which is widely used for both power generation and shipping. The problem is that existing engines that run HFO are completely unsuitable, for reason of their size and weight, for temporary applications; they are designed for permanent installation, and are very expensive to buy. Undaunted, we asked the question: could we develop an engine which would be low cost, and which would fit into a 20 foot container? We then started a multi-million pound development programme to see if we could persuade our trusty Cummins G3 engines to run HFO; this had never been done before, and would have numerous advantages, particularly if we could retrofit our existing engines to run the fuel. The programme was very successful, and in 2013 we launched our new G3+ HFO. As set out in 'What We Do', we had already developed a programme for recycling our engines at the end of their normal life to produce a brand new engine from the carcase of an old one, and have already recycled over 1,000 engines using these techniques. Now we can produce an engine at re-build that will run either HFO or diesel.

We have so far produced over 260 new HFO-capable generators, and initial customer reaction has been very favourable, as we are able to save them millions of dollars in fuel cost. In 2013 we signed contracts with eight customers across the Group for this new technology, and while we fully expect that it will take some time to establish the product in volume – as it did for gas – we believe that this product will become a very important part of our portfolio over the next five years.

This puts us in a very strong position in the Power Projects market; we are by far the largest operator, with unmatched global scale and presence, as well as the lowest capital and operating costs; we have a large Local business with whom resources can be shared; and we are the only operator to be able to offer the choice of diesel, HFO and gas-fuelled plant. Importantly, we are also making good progress towards being able to drive the costs of our temporary power down to match permanent power.

POWER PROJECTS PERFORMANCE

The targets we have set ourselves for the period 2013 – 2017 for the Power Projects business are for underlying revenue growth of between 10% and 15%; margins of between 27% and 32%; and a return on capital employed of between 25% and 30%. As with the Local business, it should be emphasised that these are the averages we would expect over a five year period, and there will be years when we may be outside one of these ranges. Our reference to 'underlying growth' above means the growth we would expect to achieve once we have adjusted for currency, pass through fuel and our contracts in Japan and with the US Military, which we expect to largely disappear over the course of 2013 and 2014.

In 2013 we missed our target for underlying revenue growth by a wide margin, achieving 4% underlying growth versus a target range of 10-15%. Trading margin, at 31% was at the top end of the target range of 27-32%; return on capital employed, at 27%, was in the middle of the target range of 25-30%. There were two reasons that we missed the revenue growth target. First, reduced levels of GDP growth and an uncertain outlook in emerging markets reduced demand. We believe that in only one area (North Africa) did demand for Power Projects grow, and elsewhere demand was flat or lower than in 2012. Secondly, in Asia specifically there was intense competition between suppliers who had excess capacity, and as a result rates, and our volumes, declined. We are not inclined to change our targets, as we regard them as averages to be achieved over a five-year period, and we would expect there to be year-on-year variation. It is worth noting that at the start of our last strategy review period we were beset by the impact of the so-called global financial crisis of 2008-2009, but managed to survive that and went on to beat our five-year targets.