Policy Report

Key principles of the remuneration policy

The Committee has adopted a number of principles which it applies to the way it sets, balances and adjudicates different elements of remuneration for the Executive Directors. As a general policy, we aim to ensure that our remuneration policy rewards executives for delivering what we see as being their central responsibility – to increase the value of the business to shareholders over a long period of time.

More specifically, our policy is to have a reward package for Executive Directors which is structured such that:

- the fixed element of pay (i.e. salary, pension and benefits) is around the median for companies of similar size and complexity;

- the majority of executive remuneration is linked to Aggreko's performance, with a heavier weighting on longterm performance than on short-term performance; and

- the remuneration packages reward a balanced portfolio of measures which deliver value for shareholders, which can be independently verified, and which give clear 'line-of-sight' to the Executives.

In determining the Company's remuneration policy, the Remuneration Committee takes into account the particular business context of Aggreko plc, the industry in which we operate, the geography of our operations, the relevant talent market(s) for each of our Executives, as well as the best practice guidelines published by institutional shareholders and their representative bodies.

We also consult our major shareholders in developing policy; see 'Consultation with shareholders and changes to remuneration'.

The policy is intended to take effect from 24 April 2014, being the date of the Company's 2014 Annual General Meeting.

SUMMARY OF AGGREKO'S REMUNERATION POLICY FOR EXECUTIVE DIRECTORS

This section of our report summarises the key components of Aggreko's remuneration policy for Executive Directors. This policy is consistent with the policy that applied to 2013.

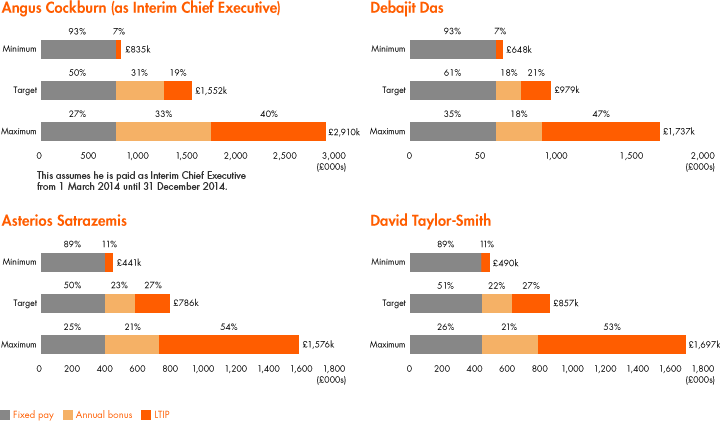

Purpose and link to strategy Operation Opportunity Performance metrics Fixed pay Base salary To attract and retain talent by ensuring base salaries are competitive in the talent market(s) relevant to each individual. We aim to pay the market median for standard performance and within the market top quartile for top quartile performance, or to recruit outstanding candidates. Base salaries are generally reviewed annually; in determining the appropriate level of adjustment, we take into account: Company performance; the individual's responsibilities and contribution to the business; salary levels for comparable roles at relevant comparators; and salary increases more broadly across the Group. In the case of the Chief Executive and the CFO, the benchmark we use is the 20 companies either side of Aggreko in the FTSE based on the average market capitalisation over the previous 12 months. For other Executive Directors, we use a similar benchmarking approach but recognise that comparability is harder to gauge and less formulaic for these roles. Any base salary increases are applied in line with the outcome of the annual review. The Chief Executive will have the highest base salary of all Executive Directors, and the maximum salary for the Chief Executive may be within the top quartile of Chief Executive salaries for the FTSE+/-20 comparators. Continued good performance. Pension To provide relevant statutory benefits and be competitive in the market in which the individual is employed. In certain cases, we need to take account of Executives' participation in defined-benefit schemes whose costs may be in excess of normal contribution rates to defined contribution schemes. A defined-contribution pension applies to all Executive Directors, with the exception of Angus Cockburn. Executives can opt to take a cash payment in lieu of all or part of their pension. Contributions of between 20% and 30% of salary p.a. except where limited by local practice. None. Angus Cockburn, who joined the Company in 2000, when the Group's defined benefit scheme was open to new joiners, opted in 2011 to receive a cash sum in lieu of further accruals in the defined benefit scheme. The cash sum is based on the estimated cost to the Company had he continued to accrue benefits under the defined benefit pension arrangements, net of his own contributions. Cash payment equates to 46% of salary p.a. The amount payable was set at £177,000, in July 2012. Henceforth it will increase at CPI subject to a minimum of 25% of salary. Benefits Designed to be competitive in the market in which the individual is employed. Expatriate and relocation packages designed to ensure a geographically mobile management population related to business needs. Includes health-care benefits, life assurance cover, and, in some cases, a Company car and expatriate package. Where appropriate the Company will bear the cost of any local taxes payable on any expatriate benefits. The Company will also bear any UK tax that Executive Directors resident overseas incur as a result of carrying out their duties in the UK. Benefits vary by role and local practice, and are reviewed periodically relative to market. Ongoing benefits (i.e. excluding expatriate benefits and relocation allowances) payable to Executive Directors did not exceed 10% of salary during the most recent financial year, and expatriate benefits and relocation allowances did not exceed 63% of salary, and it is not anticipated that in normal circumstances the cost of benefits provided will exceed this level over the next 3 years. The Committee retains the discretion to approve a higher cost in exceptional circumstances (e.g. relocation) or in circumstances where factors outside the Company's control have changed materially (e.g. increases in insurance premiums). None. Variable pay Annual Bonus Scheme Aims to focus Executive Directors on achieving demanding annual targets relating to Company performance. Performance measures and targets are set at the start of the year and are weighted to reflect the balance of Group and regional responsibilities for each executive. At the end of the year, the Remuneration Committee determines the extent to which these have been achieved. The Remuneration Committee has the ability to exercise discretion to adjust for factors outside management control. Bonus payments are typically delivered in cash, although for the Chief Executive and CFO 25% of any bonus is deferred into shares for three years unless, at the discretion of the Remuneration Committee, the individual leaves with the Company's consent. The Remuneration Committee has discretion to reduce the number of shares that can vest in the event of gross misconduct or material misstatement of the accounts. The maximum annual bonus opportunity is 175% of salary. To-date this level has been used only for the Chief Executive. Bonuses start to be earned for threshold performance (for which no bonus is paid), rising on a straight-line to deliver 50% of maximum (55% for Regional Directors) for on-budget performance. Performance is assessed annually based on challenging budget and stretch targets for Group and regional financial performance. The current measures are EPS and operating cashflow at Group level and trading profit and regional debtor days at regional level, but may vary each year depending on business context and strategy. All measures will be weighted appropriately according to business priorities with generally more weighting on earnings growth than other factors. In line with current practice, annual bonus payments will be determined solely by financial performance. Further details of the performance measures used for the 2013 annual bonus are set out in the Annual Report on Remuneration. LTIP Aims to align the interests of management with those of shareholders in growing the value of the business over the long term. Vesting of awards is subject to performance conditions based on the long term financial performance of the Group; the value of the awards is based on both the proportion vesting (i.e. the Company's financial performance) and the movement in the share price over the vesting period. A small element of the Co-investment Plan is dependent solely on retention of shares, and the value therefore driven solely by share price performance. The LTIP comprises a Performance Share Plan (PSP) and Co-investment Plan (CIP). Award levels and performance conditions are reviewed from time to time to ensure they remain appropriate and aligned with shareholder interests. The PSP provides for a nil-cost conditional award of shares worth up to a normal aggregate limit of 100% of salary per annum. This can be increased to up to 200% where the Remuneration Committee determines that exceptional circumstances exist, for example in order to recruit or retain a particular individual. To date this discretion has not been exercised. The CIP is a Co-investment plan under which selected executives can voluntarily purchase Aggreko shares up to a value of 30% of their salary, which are then subject to a maximum 'match' by the Company up to 2 shares for every 1 subscribed. Within this, 1 share for every 2 subscribed (the minimum match) is not subject to a performance condition, but is subject continued employment through the vesting period. The Committee believes that this small element which is not subject to performance conditions encourages employees – and in particular those less senior participants, who may have limited experience of incentive schemes – to participate in the CIP. There are two performance steps for the CIP and PSP. The 'basic' performance step covers both ROCE and D-EPS, and covers a range of normalised performance. In terms of D-EPS, the 'basic' performance range is 3-year compound growth in real (i.e. inflation adjusted) D-EPS of 3-10%. No shares vest under this element if performance is less than 3% and awards then increase from nil to maximum at 10% D-EPS on a straight line basis. In terms of ROCE, the targets are set by the Remuneration Committee each year, with no shares vesting at the threshold level and awards then increase from nil to maximum on a straight line basis. In addition, if real D-EPS growth exceeds 10% compound, the basic award is multiplied by a factor of 1x (at 10%) up to 2x (at 20%). Accordingly, if both the basic and super performance conditions are satisfied in full, an Executive receiving the maximum number of shares granted under normal circumstances in the PSP (100% of salary), could receive 200% of salary's worth of shares under the PSP and a 4:1 match on investment shares under the CIP. The Remuneration Committee has the discretion to make such adjustments as are necessary to ensure that the published performance figures are consistent and represent a fair measure of performance. This would include any adjustment to rectify any material misstatement of the accounts. The vesting of awards is usually subject to: 75% of the LTIP performance is measured against growth in real compound Diluted Earnings per Share, and 25% against Return on Capital Employed. Under each measure, threshold performance results in nil vesting with the exception of the CIP minimum match of 1 share for every 2 subscribed. Further details of LTIP award sizes and targets for the 2013-2015 cycle are provided in the Annual Report on Remuneration. Other Sharesave To align the interests of employees and shareholders by encouraging all employees to own Aggreko shares. This is an all-employee scheme whereby all employees including Executive Directors with at least three months' continuous service may save up to £250 per month over a period of two to five years. Options under the Sharesave Option Schemes and the US Stock Purchase Plan are granted at a discount of 20% and 15% respectively. Savings capped at £250 a month. The Committee may consider raising this figure to up to £500 a month to reflect the proposed increase in the statutory limit for UK schemes. None. The Committee is satisfied that the above remuneration policy is in the best interests of shareholders and does not promote excessive risk-taking. The Committee retains discretion to make non-significant changes to the policy without reverting to shareholders. Executive Directors remain eligible to receive payment under any contractual arrangement agreed prior to the approval and implementation of the remuneration policy, i.e. before 24 April 2014. However, there are no such arrangements in place for the current Executive Directors. The measures used under the Annual Bonus Plan reflect the Company's key financial objectives for the year. The Committee considers that EPS (used in both the Annual Bonus Plan and LTIP) is an objective and wellaccepted measure of the Company's performance which reinforces the strategic objective of achieving profitable growth. The additional use of Group cashflow for the Chief Executive and CFO rewards the effective management of working capital. Targets for the Annual Bonus Scheme are tied to the Annual Budgets set by the Board and have due regard to external forecasts. Performance targets are set to be stretching but achievable and take into account the economic environment in a given year. Generally, bonuses will start to be earned at performance levels a few percentage points below Budget, increase sharply to Budget, and then increase until they reach capped levels, which will generally be around 10% above Budget. Under the LTIP, Group D-EPS is complemented by ROCE to reflect the need to balance growth and returns. Targets applying to the LTIP are reviewed annually, based on a number of internal and external reference points to ensure they remain appropriately stretching. The table below summarises our policy on the remuneration paid to our Non-executive Directors and Chairman. Purpose and Performance metrics To attract and retain Non-executive Directors with an appropriate degree of skills, experience, independence and knowledge of the Company and its business. To attract and retain a Chairman to provide effective leadership for the Board. Fee levels for Non-executive Directors are generally reviewed by the Board annually, with any adjustments effective 1 January in the year following review. Remuneration comprises an annual fee for acting as a Non-executive Director and serving as a member of any Committees. Additional fees are paid in respect of service as Chairman of a Committee or the Senior Independent Director. Remuneration for the Chairman comprises an annual fee for acting as Chairman, and serving as Chairman or as a member of any Committees. The Remuneration Committee sets the Chairman's remuneration, subject to review when appropriate. When reviewing fees, reference is made to fees for the same comparator group as used for Executive Directors, information provided by a number of remuneration surveys, the extent of the duties performed and the size of the Company. Non-executive Directors do not participate in incentive arrangements or, receive other remuneration in addition to their fees. However, where appropriate the Company may provide additional benefits in kind, which are not expected to exceed 20% of the annual fee in any year. Any fee increases are applied in line with the outcome of the annual review. Currently the maximum aggregate annual fee for all Directors provided in the Company's Articles of Association is £750,000 but at the Annual General Meeting a resolution will be put to shareholders to increase it to £900,000. Continued good performance. The Company's approach to remuneration for newly appointed Directors is identical to that for existing Directors. As a matter of practicality, it is recognised that it may be necessary to pay within the market top quartile salaries in order to attract candidates of the quality the business needs. New Executive Directors will be invited to participate in incentive plans on the same basis as existing Executive Directors. However, the Committee may alter the performance measures, performance period, reference salary and vesting period of the annual bonus or LTIPs, subject to the rules of the Plans, if the Committee determines that the circumstances of the recruitment merit the alteration. The Committee will explain the rationale for any such changes. Where appropriate the Company will offer to pay reasonable relocation expenses for new Executive Directors in line with the Company's policies described above. It is not the Company's policy to offer sign-on payments, but where the Remuneration Committee considers it is necessary to do so in order to recruit a particular individual, it may offer compensation for amounts of variable remuneration under previous employment being forfeited. In doing so, the Committee will consider all relevant factors including time to vesting, delivery vehicle (cash vs. shares vs. options), any performance conditions attached to the awards and the likelihood of the conditions being met. In order to facilitate such compensation the Committee may rely on the exemption contained in Listing Rule 9.4.2, which allows for the grant of awards in exceptional circumstances to facilitate the recruitment of a Director. Where the Company is considering the promotion of senior management to the Board, the remuneration Committee may, at its discretion, agree that any commitments made before promotion will continue to be honoured whether or not consistent with the policy prevailing at the time the commitment is fulfilled. In recruiting a new Non-executive Director, the Remuneration Committee will use the policy as set out in the table in the Annual Report on Remuneration. A base fee in line with the prevailing fee schedule would be payable for acting as a Non-executive Director and serving as a member of any Committees, with additional fees payable for acting as Chairman of a Committee or as Senior Independent Director. In recruiting a new Chairman of the Board, the fee offered would be inclusive of serving on any Committees. The graphs below provide estimates of the potential future reward opportunities for Executive Directors, and the potential split between the different elements of remuneration under three different performance scenarios: 'Minimum', 'Target' and 'Maximum'. We have not included opportunities for Rupert Soames who resigned with effect from 24 April 2014. Potential reward opportunities illustrated above are based on the remuneration policy, applied to the base salary in force at 1 January 2014. For the annual bonus, the amounts illustrated are those potentially receivable in respect of performance for 2014. For the CIP, the award opportunities assume full voluntary investment in Aggreko shares. It should be noted that the LTIP awards granted in a year do not normally vest until the third anniversary of the date of grant. The projected value of LTIP amounts excludes the impact of share price movement. In illustrating potential reward opportunities the following assumptions are made: Annual bonus LTIP Fixed pay Minimum No annual bonus payable Threshold not achieved but minimum amount vesting under the CIP Latest base salary, " " Target On target annual bonus Performance warrants 25% vesting Maximum Maximum annual bonus Performance warrants full vesting The policy and practice with regard to the remuneration of senior executives below the Board is consistent with that for the Executive Directors. Senior executives participate in the LTIP with the same performance measures applied. In 2013, 155 individuals – about 2.6% of employees – were invited to join one or both of the Plans. In making remuneration decisions, the Remuneration Committee also considers the pay and employment conditions elsewhere in the Group, and is informed of changes to broader employee pay. The Remuneration Committee does not specifically consult with employees over the effectiveness and appropriateness of the remuneration policy or use any remuneration comparison measurements, although as members of the Board they receive the results of the Company's periodical employee satisfaction survey which includes questions covering remuneration. It is the Company's policy to provide for 12 months' notice for termination of employment for Executive Directors, to be given by either party. For Executive Directors who have been newly recruited from outside the Group, the period would normally be six months, increasing to 12 months after 12 months' service. The Company's policy is to limit severance payments on termination to pre-established contractual arrangements; if the Company believes it appropriate to protect its interests, it may also make additional payments in exchange for non-compete/non-solicitation terms which are above and beyond those in the Director's contract of employment. Typically, these will serve to extend the non-compete period for up to three years from the date of termination. The Committee has discretion to contribute towards the legal fees for any departing Director to the extent it considers appropriate. Under normal circumstances, the Company may terminate the employment of an Executive Director by making a payment in lieu of notice equivalent to basic salary and benefits for the notice period at the rate current at the date of termination. In case of gross misconduct, a provision is included in the Executive's contract for immediate dismissal with no compensation payable. In the event an Executive Director leaves for reasons of death, ill-health, injury, redundancy, retirement with the agreement of the Company, or his employing Company's ceasing to be a member of the Group or other such event as the Remuneration Committee determines, then Performance Share Plan awards held for less than one year will lapse; those held for more than one year will be pro-rated for time and will vest based on performance over the performance period as determined by the Remuneration Committee. Co-investment Plan awards held for less than one year will give the Minimum Match only; those held for more than one year will vest over the Minimum Match and will be pro-rated for time and vest as soon as practicable after the date of leaving, based on performance up to that date. Upon the occurrence of a takeover, scheme of arrangement, winding-up or a demerger (a 'Corporate Event'), Performance Share Plan awards held for less than one year will lapse: Co-investment Plan awards held for less than one year will vest in part in respect only of the Minimum Match (i.e. on a 1:2 basis). LTIP awards granted at least 12 months prior to the date of the relevant Corporate Event will vest to the extent that, in the opinion of the Committee, the Performance Conditions have been/or would have been satisfied on the date of the relevant Corporate Event. For all other leavers, outstanding LTIP awards will normally lapse. The Remuneration Committee retains discretion to vary the extent to which awards vest on a case-by-case basis, following a review of circumstances, to ensure fairness for both shareholders and participants. It is the Board's policy to allow the Executive Directors to accept directorships of other quoted companies. Any such directorships must be formally approved by the Chairman of the Board. Details of external directorships held by Executive Directors, together with fees retained during the year are as follows: Executive Director Company Role(s) held Fees retained Rupert Soames Electrocomponents plc Senior Independent Director and Chairman of Remuneration Committee £55,000 Angus Cockburn Howden Joinery Group plc* Non-executive Director £35,567 GKN plc Non-executive Director £55,000 * Fee was for the period 1 January 2013 to date of resignation, 18 September 2013.

continued employment;

continued employment; the Company's performance over a 3-year performance period.

the Company's performance over a 3-year performance period.

Payments from outstanding awards

Performance measure selection and approach to target setting

SUMMARY OF AGGREKO'S REMUNERATION POLICY FOR NON-EXECUTIVE DIRECTORS AND CHAIRMAN

link to strategy

Operation

Opportunity

APPROACH TO RECRUITMENT REMUNERATION

PAY-FOR-PERFORMANCE: SCENARIO ANALYSIS

pension, ongoing benefits

EMPLOYMENT CONDITIONS ELSEWHERE IN THE COMPANY

SERVICE CONTRACTS AND POLICY ON PAYMENT FOR LOSS OF OFFICE

TREATMENT OF LONG TERM INCENTIVE AWARDS ON TERMINATION OF EMPLOYMENT

EXTERNAL APPOINTMENTS