Annual Report on Remuneration

The following section provides details of how the remuneration policy was implemented during the year.

REMUNERATION COMMITTEE MEMBERSHIP IN 2013

The Remuneration Committee is composed of four independent Non-executive Directors, together with the Chairman of the Company (who was an Independent Non-executive Director before his appointment as Chairman).The Group Legal Director and Company Secretary, Peter Kennerley, is Secretary to the Committee. The Remuneration Committee met five times during the year. Attendance at meetings by individual members is detailed in the Corporate Governance Report. The Committee consulted the Chief Executive, Rupert Soames, and the Group Human Resources Director, Siegfried Putzer, and invited them to attend meetings when appropriate. No Director is present when his own remuneration is being discussed.

Committee members:

| Russell King | Chairman |

| David Hamill | |

| Ken Hanna | |

| Robert MacLeod | |

| Rebecca McDonald |

THE REMUNERATION COMMITTEE'S MAIN ACTIVITIES FOR 2013

The main tasks for the Committee during 2013 were:

- Reviewed and approved the Executive Directors' bonuses for 2012.

- Set targets for Executive Directors' bonuses for 2013.

- Reviewed performance and approved the vesting of 2010 LTIP awards.

- Reviewed and approved targets for the 2013 LTIP grant.

- Approved the proposed remuneration packages for the new Regional Director for EMEA.

- Consulted with major shareholders on proposed changes to remuneration policy.

- Reviewed the changes in reporting requirements and ensured that Aggreko was compliant.

CONSIDERATION BY THE DIRECTORS OF MATTERS RELATING TO DIRECTORS' REMUNERATION

The Committee re-appointed Kepler Associates and New Bridge Street (which is part of Aon plc) as the principal external advisers to the Committee for 2013. The fees paid to advisers in respect of work that materially assisted the Committee in 2013 are shown in the table below.

Adviser Appointed by Services provided to the Committee Fees paid by Other services Kepler Associates Appointed by Russell King on behalf of the Committee Review of LTIP award calculations Advice on DRR disclosure Advice on matters on current market Benchmarking of Executive pay £56,120 Charged on a time/cost basis Provided the Board with specific data on Non-executive Director benchmarking New Bridge Street Appointed by Peter Kennerley, Company Secretary, on behalf of the Committee Advice on amendments to LTIP Advice on DRR disclosure £29,165 Charged on a time/cost basis General advice on LTIP and Sharesave Schemes Simmons & Simmons LLP Appointed by Peter Kennerley, Company Secretary, on behalf of the Committee Advice on amendments to LTIP £12,865 Charged on a time/cost basis – Except as provided above, none of these advisers provides any other services to the Group. Kepler Associates and New Bridge Street are members of the Remuneration Consultants Group and signatories to its code of conduct and Simmons & Simmons LLP is authorised and regulated by the Solicitors Regulation Authority. Taking these factors into account, the Committee is satisfied as to the impartiality and objectivity of their advice. The advisers were also chosen because of their existing knowledge of the Group's remuneration arrangements. The table below sets out a single figure for the total remuneration received by each Director for the years ended 31 December 2013 and 31 December 2012.

LTIP Year Base Benefits Annual bonus PSP CIP Sharesave Pension Total Executive Directors Rupert Soames1 2013 675,000 46,099 586,228 128,455 149,567 – 202,500 1,787,849 Rupert Soames 2012 647,500 42,876 50,701 1,075,475 690,536 – 178,752 2,685,840 Angus Cockburn2 2013 400,000 24,179 397,608 53,961 89,737 – 183,876 1,149,361 Angus Cockburn 2012 385,000 35,223 24,036 451,705 414,315 – 178,494 1,488,773 Debajit Das3 2013 306,482 221,761 158,378 20,548 47,842 – 61,639 816,650 Asterios Satrazemis4 2013 319,530 100,000 133,168 24,805 57,749 39 25,563 660,854 David Taylor-Smith5 2013 274,615 13,751 287,300 – – 1,166 54,923 631,755 Non-executive Directors Ken Hanna 2013 310,000 – – – – – – 310,000 Ken Hanna6 2012 229,000 – – – – – – 229,000 David Hamill 2013 75,000 – – – – – – 75,000 David Hamill 2012 70,000 – – – – – – 70,000 Russell King 2013 75,000 – – – – – – 75,000 Russell King 2012 70,000 – – – – – – 70,000 Diana Layfield 2013 55,000 – – – – – – 55,000 Diana Layfield7 2012 37,000 – – – – – – 37,000 Robert MacLeod 2013 75,000 – – – – – – 75,000 Robert MacLeod 2012 70,000 – – – – – – 70,000 Rebecca McDonald 2013 55,000 – – – – – – 55,000 Rebecca McDonald8 2012 14,000 – – – – – – 14,000 Ian Marchant9 2013 9,167 – – – – – – 9,167

the Company

for the services

practice

performance conditions

performance conditions

SINGLE TOTAL FIGURE OF REMUNERATION

salary/fees

£

£

£

£

£

£

£

£

- 1This represents the cash element of the bonus. Rupert Soames forfeited the 25% deferred element following his resignation.

- 2This total bonus includes the 25% deferred share element.

- 3This is paid in local currency and for the purposes of this table has been converted into Sterling using the average year to date exchange rate of £1 = SG$1.9577.

- 4This is paid in local currency and for the purposes of this table has been converted into Sterling using the average year to date exchange rate of £1 = US$1.5648.

- 5Appointed to the Board on 11 March 2013.

- 6Appointed Chairman on 25 April 2012.

- 7Appointed to the Board on 1 May 2012.

- 8Appointed to the Board on 1 October 2012.

- 9Appointed to the Board on 1 November 2013.

The figures have been calculated as follows:

- Base salary/fees: amount earned for the year. See Base salary below.

- Benefits: the value of benefits received in the year. See Benefits below.

- Annual bonus: the total bonus earned on performance during the year. See Annual Bonus Scheme below.

- 2013 remuneration from LTIPs refers to share awards subject to a performance period ended 31 December 2013 which were granted on 19 April 2011 (and so are referred to in this report as '2011 LTIPs') and are due to vest on 19 April 2014. The value is based on the average share price over the last quarter of 2013 of 1565p. See Long-term Incentive Plan – 2011 LTIP awards.

- 2012 remuneration from LTIPs refers to share awards subject to a performance period ended 31 December 2012 which were granted on 15 April 2010 (and so are referred to in this report as '2010 LTIPs') and vested on 15 April 2013. The value is based on the share price on 15 April 2013 of 1789p. See Long-term Incentive Plan – 2010 LTIP awards.

- Sharesave: Asterios Satrazemis and David Taylor-Smith were granted Sharesave options on 8 October 2013. The value is based on the market price of an Aggreko share on the date of grant, of 1472p, less the option price of 1303p, multiplied by the number of options. See the Scheme Interests Awarded in 2013 table.

- Pension: the amount of any Company pension contributions and cash in lieu. See Pensions below.

Base salary

Annual salaries for Executive Directors are generally reviewed each year by the Committee. Salaries are determined by a combination of Company performance, the individual's responsibilities and contribution to the business, salary levels for comparable roles at relevant comparators, and salary increases more broadly across the Group. We aim to pay the market median for standard performance and within the market top quartile for top quartile performance or to recruit outstanding candidates. In setting Executive Director salaries, as with other elements of their remuneration, the Committee has discretion to consider all relevant factors, including performance on environmental, social and governance issues.

The appropriate market rate is the rate in the market place from which the individual is most likely to be recruited. The Company operates in a number of market places throughout the world where remuneration practices and levels differ. This can result in pay and benefit differentials between the Executive Directors. In arriving at an appropriate market rate, we commission studies from our advisers, who carry out in-depth research on the practices of Aggreko's peer group to establish accurate benchmarks. The same approach is taken for expatriate and overseas salaries where reference is made to the appropriate data for the geographical location.

During the year the Committee decided to defer the salary review date for Executive Directors from 1 July to 1 January in order to conform with the Company's financial year. On 1 January 2014 each Executive Director received an increase of 3% in base salary, although Rupert Soames and Angus Cockburn declined the increase.

The base salaries for Executive Directors as at 1 January 2014, 31 December 2013 and 31 December 2012 are shown below:

|

|

|

|

|

|

|

31 December 2012 |

|

Rupert Soames |

Chief Executive |

£675,000 |

– |

£675,000 |

– |

£675,000 |

|

Angus Cockburn |

Chief Financial Officer |

£400,000 |

– |

£400,000 |

– |

£400,000 |

|

Debajit Das |

Regional Director, Asia Pacific |

£315,6771 |

3% |

£306,4823 |

– |

– |

|

Asterios Satrazemis |

Regional Director, Americas |

£329,1162 |

3% |

£319,5304 |

– |

– |

|

David Taylor-Smith |

Regional Director, Europe, |

£350,000 |

3% |

£340,000 |

– |

– |

- 1 This is paid in local currency SG$618,000 and for the purposes of this table has been converted into Sterling using the average year to date exchange rate of £1 = SG$1.9577.

- 2 This is paid in local currency US$515,000 and for the purposes of this table has been converted into Sterling using the average year to date exchange rate of £1 = US$1.5648.

- 3 This is paid in local currency SG$600,000 and for the purposes of this table has been converted into Sterling using the average year to date exchange rate of £1 = SG$1.9577.

- 4 This is paid in local currency US$500,000 and for the purposes of this table has been converted into Sterling using the average year to date exchange rate of £1 = US$1.5648.

Benefits

All the Executive Directors receive health-care benefits, life assurance cover, income protection and accident insurance. Rupert Soames and Angus Cockburn receive the benefit of a Company-funded car and David Taylor- Smith, receives a car allowance. Debajit Das receives an overseas secondment package to cover housing, travel allowance, Company-funded car, fuel allowance, utilities allowance, a contribution to school fees and re-imbursement of certain taxes. Asterios Satrazemis is entitled to a repatriation allowance to cover the cost of returning to the USA from Australia which includes an accommodation allowance and contribution to school fees; he is also entitled to receive a car allowance and re-imbursement of certain taxes.

The following table identifies those benefits that the Committee considers significant.

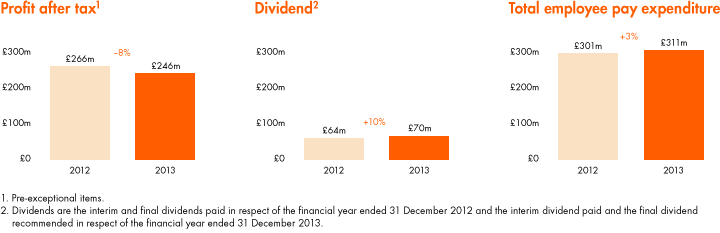

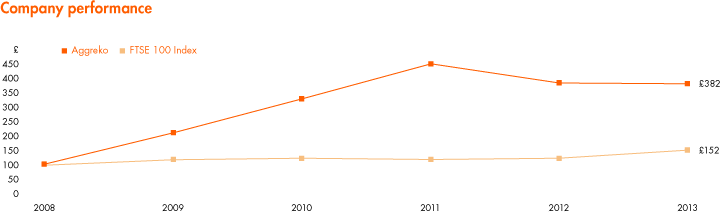

Car/fuel Housing School fees Travel Tax Other Total Rupert Soames £27,271 – – – – £18,828 £46,099 Angus Cockburn £17,104 – – – – £7,075 £24,179 David Taylor-Smith £9,692 – – – – £4,059 £13,751 Debajit Das £22,674 £98,074 £29,380 £21,733 £40,218 £9,682 £221,761 Asterios Satrazemis £17,221 £51,125 £12,781 – £8,368 £10,505 £100,000 Annual Bonus Scheme The targets for the Annual Bonus Scheme are tied to the Annual Budgets set by the Board and have due regard to external forecasts. Generally, bonuses will start to be earned at performance levels a few percentage points below Budget, increase sharply to Budget, and then increase until they reach capped levels, which will generally be around 10% above Budget. Executive Directors with regional management responsibilities have half of their bonus related to the performance of their region (as measured by trading profit and debtor days) and half related to Diluted Earnings Per Share (D-EPS). The Chief Executive's and Chief Financial Officer's bonuses are measured three quarters against D-EPS with the balancing quarter being measured against operating cashflows. This element was introduced in 2013 to provide a more complete assessment of performance by linking a proportion of the bonus to cashflow. Bonus payments are typically delivered in cash, although for the Chief Executive and Chief Financial Officer 25% of any bonus is deferred into shares for three years unless, at the discretion of the Remuneration Committee, the individual leaves with the Company's consent. The Remuneration Committee has discretion to reduce the number of shares that can vest in the event of gross misconduct or material misstatement of the accounts. In 2013 the on-budget and maximum bonus earnings for the Executive Directors were: D-EPS Operating cashflow Regional trading profit Regional debtor days Total max bonus Max bonus On budget bonus Max bonus On budget bonus Max bonus On budget bonus Max bonus On budget bonus Rupert Soames 175 131 65.5 44 22 – – – – Angus Cockburn 150 112.5 56.3 37.5 18.8 – – – – Debajit Das 100 50 25 – – 40 20 10 10 Asterios Satrazemis 100 50 25 – – 40 20 10 10 David Taylor-Smith 100 50 25 – – 40 20 10 10 Growth in D-EPS and operating cashflow are calculated on a constant currency basis, using exchange rates fixed at the beginning of the year, so that the bonus reflects the true performance of the business, and not currency movements. For 2013, the Budget D-EPS for bonus purposes was set at 90.63. The cut-in point, at which bonus started to be earned, was 98% of budget (88.82p) and the maximum bonus would have been reached at 108% of budget (97.88p). The actual outcome on the adjusted basis set out above was 96.45p, representing 106.4% of Budget. The Committee then used its discretion to adjust D-EPS downward to 95.47p, representing 105.3% of Budget as the Committee believes that this better represents performance against targets. For the Chief Executive and Chief Financial Officer the Budget operating cashflow for bonus purposes was set at £663.2 million. The cut-in point, at which bonus started to be earned, was 92.5% of budget (£613.5 million) and the maximum bonus would have been reached at 107.5% of budget (£713 million). The actual outcome on the adjusted basis set out above was £628.4 million, representing 95% of Budget. The table below sets out the total bonus entitlement for each Executive Director for 2013: D-EPS Operating cashflow Regional trading profit Regional debtor days Executive Director Total max bonus Max bonus % of budget achieved % Max bonus % of budget achieved % Max bonus % of budget achieved % Max bonus Actual (days) % Total outcome (% salary) Total Rupert Soames 175 131 105.3 109 44 95 7 – – – – – – 116 781,6371 Angus Cockburn 150 112.5 105.3 93 37.5 95 6 – – – – – – 99 397,6082 Debajit Das 100 50 105.3 42 – – – 40 94 0 10 61 10 52 158,378 Asterios Satrazemis 100 50 105.3 42 – – – 40 92 0 10 60 0 42 133,168 David Taylor-Smith 100 50 105.3 42 – – – 40 107 33 10 78 10 85 287,3003 Pensions In 2002 the Company closed its Defined Benefits scheme for UK employees to new joiners, and as a consequenceAngus Cockburn is the only Director who is a member of this scheme. Of the other Executive Directors, RupertSoames, Debajit Das and David Taylor-Smith are members of the Aggreko Group Personal Pension Plan, which is a defined contribution scheme. Rupert Soames is entitled to a pension contribution from the Company of 30% of his basic salary (25% prior to 1 July 2012) and other Executives are entitled to a Company contribution of 20%. With effect from April 2011 no further contributions are being made to the Plan for Rupert Soames and he receives a cash payment in lieu of 30% of his basic salary. Other Executive Directors have elected to take part of the Company contribution into the Group Personal Pension Plan and part as a cash payment. These cash payments are shown as Cash payments in lieu of pension in the table below. Asterios Satrazemis is entitled to participate in the Employees' Savings Investment Retirement plan and the Supplemental Executive Retirement plan of Aggreko LLC, which is governed by the laws of the United States. These plans allowed contributions by the employee and the Group to be deferred for tax. Contributions paid by the Company under the defined contribution plans during the year are as follows: 2013 2012 Executive Director Paid to pension Paid cash Total Paid to pension Paid cash Total Rupert Soames – £202,500 £202,500 – £178,752 £178,752 Angus Cockburn – £183,876 £183,876 – £178,494 £178,494 Debajit Das £10,503 £51,1361 £61,639 – – – Asterios Satrazemis2 £25,563 – £25,563 – – – David Taylor-Smith £11,333 £43,590 £54,923 – – –

1 This is paid in local currency SGD100,109 and for the purposes of this table has been converted into Sterling using the average year to date exchange rate of £1 = SG$1.9577.

2 This is paid in local currency US$40,000 and for the purposes of this table has been converted into Sterling using the average year to date exchange rate of £1 = US$1.5648. Angus Cockburn joined the Company before 1 April 2002 and is a member of the Aggreko plc Pension Scheme which is a funded, defined benefit scheme approved by Her Majesty's Revenue & Customs. The key elements of his benefits are: As a result of opting out of making further contributions to the Aggreko plc Pension Scheme with effect from 30 April 2011, Angus Cockburn now receives a cash payment in lieu of the pension he would otherwise have built up. This cash payment is paid net of the member contributions he would have been required to pay to the scheme and is broadly an estimate of the cost to the Company of providing the benefits being given up. For 2013 the cash payments were equivalent to £183,876 (2012: £178,494). The amount will be adjusted by CPI growth each year subject to a minimum of 25% of salary. This is shown in the pension column of the Single Figure Table column above. Angus Cockburn is also entitled to a pension of £2,162 per annum payable from age 60 from the Aggreko plc Pension Scheme resulting from benefits transferred in from the scheme of a previous employer. This benefit is not included in the above disclosure. Long-term Incentive Plan The PSP and CIP are both measured against performance over three financial years and they share the same performance criteria. These are the real compound annual growth rate of Diluted Earnings per Share (D-EPS), and Return on Capital Employed (ROCE). This directly aligns both elements of the LTIP with Group strategy and measures performance against what the Board believes are Key Performance Indicators. The PSP is a nil-cost conditional award of shares which vest depending on performance against the targets; the number of shares conditionally awarded is related to the salary of the individual concerned and his or her level within the Company. The PSP provides for annual awards of performance shares up to an aggregate limit of 100% of salary in normal circumstances and 200% of salary in exceptional circumstances. The CIP is a Co-investment plan, whose purpose it is to encourage executives to buy and hold shares in the Company. Participants can subscribe to purchase Aggreko shares up to a value of 30% of their salary, each year that they are invited to join the CIP; if they hold those shares for three years, (or, if earlier, the date that their CIP award vests), they will be entitled to receive a minimum award of one share for every two they subscribed (the Minimum Match), plus a performance-related award of a further three shares for every two they subscribed. The Minimum Match is not subject to performance conditions. The performance criteria for the LTIP are set annually. Awards granted in 2010 vested on 15 April 2013. The performance criteria for the 2010 LTIP were as follows: In addition to the above, and to reward truly exceptional performance, the number of shares awarded to participants in both elements of the 2013 LTIP might be increased by between 1.3 and 2 times if the real compound annual growth in D-EPS over the three-year performance measurement period was in a range of 13% to 20%. The performance period for the 2010 LTIP awards ended on 31 December 2012. Over the period: This combined performance resulted in the 2010 LTIP awards which were subject to performance conditions, vesting at a level of 100%. Further, as real compound annual growth in D-EPS was 14.5%, the number of shares increased by 1.45 times. Awards granted in 2011 are due to vest on 19 April 2014. The performance criteria for the 2011 LTIP awards were as follows: In addition to the above, and to reward truly exceptional performance, the number of shares awarded to participants in both elements of the 2013 LTIP might be increased by between 1.3 and 2 times if the real compound annual growth in D-EPS over the three-year performance measurement period was in a range of 13% to 20%. The performance period for the 2011 LTIP awards ended on 31 December 2013. Over the period: The combined performance will result in the 2011 LTIP awards which were subject to performance conditions, vesting at a level of 21%. As real compound annual growth in D-EPS was 5%, and so below 13%, there was no increase in the number of shares vested. The following table shows details of LTIPs vested in 2013 or due to vest in 2014. Executive Director Year in which performance Vested Date vested Estimated market Value Performance Share Plan Rupert Soames 2013 8,208 19 April 2014 1565p £128,455 Rupert Soames 2012 60,116 15 April 2013 1789p £1,075,475 Angus Cockburn 2013 3,448 19 April 2014 1565p £53,961 Angus Cockburn 2012 25,249 15 April 2013 1789p £451,705 Debajit Das 2013 1,313 19 April 2014 1565p £20,548 Debajit Das 2012 8,875 15 April 2013 1789p £158,774 Asterios Satrazemis 2013 1,585 19 April 2014 1565p £24,805 Asterios Satrazemis 2012 11,841 15 April 2013 1789p £211,835 Co-investment Plan Rupert Soames 2013 9,557 19 April 2014 1565p £149,567 Rupert Soames 2012 38,599 15 April 2013 1789p £690,536 Angus Cockburn 2013 5,734 19 April 2014 1565p £89,737 Angus Cockburn 2012 23,159 15 April 2013 1789p £414,315 Debajit Das 2013 3,057 19 April 2014 1565p £47,842 Debajit Das 2012 11,397 15 April 2013 1789p £203,892 Asterios Satrazemis 2013 3,690 19 April 2014 1565p £57,749 Asterios Satrazemis 2012 15,205 15 April 2013 1789p £272,017 The market price of Aggreko shares on 15 April 2010, being the date of grant of the 2010 LTIP was 1189p and the market price on 19 April 2011, being the date of grant of the 2011 LTIP was 1535p. Therefore the value of the award to participants in the 2010 LTIP and 2011 LTIP derived from share price accretion during the period was 50% and 2% respectively. The value of the 2011 LTIP on vesting is based on the average price of Aggreko shares over the last quarter of 2013 of 1565p. The performance criteria for the 2012 LTIPs were identical to those for 2011. The Board believes that Sharesave schemes are valuable in aligning the interests of employees and shareholders, and the Company seeks to make it possible for as many employees as practicable to join the scheme or its various proxies. In 2013, there were 1,722 employees in Aggreko subscribing to Sharesave Plans. The Aggreko Sharesave Plans are normally offered annually to employees and Executive Directors who have at least three months' continuous service, and allow a maximum of £250 per month to be saved and converted into Aggreko shares at the end of either two, three or four year periods, depending on local legislation. The options under the Sharesave Option Schemes have been granted at a 20% discount on the share price calculated over the three days prior to the date of invitation to participate, mature after three years and are normally exercisable in the six months following the maturity date. The options under the US Stock Purchase Plan have been granted at a discount of 15% on the closing share price on the date of grant, mature after two years and are normally exercisable in the three months following the maturity date. The Board determines the remuneration policy and level of fees for the Non-executive Directors, within the limits set out in the Articles of Association. The Remuneration Committee recommends remuneration policy and level of fees for the Chairman of the Board. Remuneration comprises an annual fee for acting as a Chairman or Nonexecutive Director of the Company. Additional fees are paid to Non-executive Directors in respect of service as Chairman of the Audit and Remuneration Committees and as Senior Independent Director. When setting these fees, reference is made to information provided by a number of remuneration surveys, the extent of the duties performed, and the size of the Company. The Chairman and Non-executive Directors are not eligible for bonuses, retirement benefits or to participate in any share scheme operated by the Company. The current fees are: Role Fee Chairman fee £310,000 Non-executive Director base fee £60,000 Committee Chairman additional fee £20,000 Senior Independent Director additional fee £20,000 The Chairman's fee was set in March 2012 with effect from his date of appointment, 25 April 2012 for a period of two years, and the additional fees for Committee chairmen and the Senior Independent Director were increased from £10,000 to £20,000 with effect from 1 July 2012. The basic fee for Non-executive Directors was increased from £55,000 to £60,000 per annum, with effect from 1 January 2014. The dates of the Chairman's and Non-executive Directors' appointments who served during the reporting period were as follows: Non-executive Director Position Effective date of contract Ken Hanna Chairman 25 April 2012 David Hamill Non-executive Director 1 May 2013 Russell King Non-executive Director 2 February 2012 Diana Layfield Non-executive Director 1 May 2012 Robert MacLeod Non-executive Director 10 September 2013 Rebecca McDonald Non-executive Director 1 October 2012 Ian Marchant Non-executive Director 1 November 2013 Non-executive Directors are appointed for a term of three years, subject to three months notice from either party. They are also subject to annual re-election at each Annual General Meeting. In August 2013 each of the Executive Directors was granted awards of shares under the PSP and CIP ranging from 75% to 100% of salary. The three year performance period over which D-EPS and ROCE performance will be measured began on 1 January 2013 and will end on 31 December 2015. None of the awards granted under the 2013 LTIP are eligible to vest until 5 August 2016 (except in certain circumstances where a CIP participant ceases to be an employee of the Group, as described the section 'Employment Conditions Elsewhere in the Company'). The performance conditions attached to awards are as follows. In addition to the above, and to reward truly exceptional performance, the number of shares awarded to participants in both elements of the 2013 LTIP may be increased by between 1 and 2 times if the real compound annual growth in D-EPS over the three-year performance measurement period is in a range of 10% to 20%. Sharesave plans Summary table of 2013 grant PSP CIP Sharesave Executive Director Shares Face value % vesting Shares Face value % vesting Shares Face value % vesting Rupert Soames 82,166 1,349,166 – 49,300 809,506 25% – – – Angus Cockburn 41,388 679,591 – 29,216 479,727 25% – – – Debajit Das 29,064 477,231 – 23,248 381,732 25% – – – Asterios Satrazemis 30,042 493,290 – 24,032 394,605 25% 690 1,166 100% David Taylor-Smith 31,040 509,677 – 24,832 407,741 25% 23 39 100% The following table shows the interests of the Directors who served during the year in the Group's LTIP and Sharesave plans. 31.12.2012 Granted Vested/exercised during year 31.12.2013 Option price Date from which exercisable Performance Share Plan Rupert Soames 82,918 – 60,116 – nil 15.04.2013 Rupert Soames 78,176 – – 78,176 nil 19.04.2014 Rupert Soames1 55,210 – – 55,210 nil 16.04.2015 Rupert Soames1 – 82,166 – 82,166 nil 05.08.2016 Angus Cockburn 34,826 – 25,249 – nil 15.04.2013 Angus Cockburn 32,834 – – 32,834 nil 19.04.2014 Angus Cockburn 23,064 – – 23,064 nil 16.04.2015 Angus Cockburn – 41,388 – 41,388 nil 05.08.2016 Debajit Das – 8,875 – nil 15.04.2013 Debajit Das 12,504 – – 12,504 nil 19.04.2014 Debajit Das 9,712 – – 9,712 nil 16.04.2015 Debajit Das – 29,064 – 29,064 nil 05.08.2016 Asterios Satrazemis – – 11,841 – nil 15.04.2013 Asterios Satrazemis 15,092 – – 15,092 nil 19.04.2014 Asterios Satrazemis 11,376 – – 11,376 nil 16.04.2015 Asterios Satrazemis – 30,042 – 30,042 nil 05.08.2016 David Taylor-Smith – 31,040 – 31,040 nil 05.08.2016 Co-investment Plan Rupert Soames 53,240 – 38,599 – nil 15.04.2013 Rupert Soames 46,904 – – 46,904 nil 19.04.2014 Rupert Soames1 33,124 – – 33,124 nil 16.04.2015 Rupert Soames1 – 49,300 – 49,300 nil 05.08.2016 Angus Cockburn 31,944 – 23,159 – nil 15.04.2013 Angus Cockburn 28,144 – – 28,144 nil 19.04.2014 Angus Cockburn 19,768 – – 19,768 nil 16.04.2015 Angus Cockburn – 29,216 – 29,216 nil 05.08.2016 Debajit Das 15,720 – 11,397 – nil 15.04.2013 Debajit Das 15,004 – – 15,004 nil 19.04.2014 Debajit Das 11,656 – – 11,656 nil 16.04.2015 Debajit Das – 23,248 – 23,248 nil 05.08.2016 Asterios Satrazemis 20,972 – 15,205 – nil 15.04.2013 Asterios Satrazemis 18,112 – – 18,112 nil 19.04.2014 Asterios Satrazemis 13,652 – – 13,652 nil 16.04.2015 Asterios Satrazemis – 24,032 – 24,032 nil 05.08.2016 David Taylor-Smith – 24,832 – 24,832 nil 05.08.2016 Sharesave Options Rupert Soames 726 – – 726 1239p 01.01.2014 Angus Cockburn 714 – – 714 1260p 01.01.2015 Asterios Satrazemis2 713 – – 713 1260p 01.01.2015 David Taylor-Smith – 690 – 690 1303p 01.01.2017 US Stock Purchase Plan Asterios Satrazemis3 – 23 – 23 1303p 01.12.2015 1 These awards will lapse on 24 April 2014 upon Rupert Soames' resignation. 2 The International Sharesave Plan is set in local currency AUD option price = $20.23. 3 The US Stock Purchase Plan is set in local currency USD option price = $20.14. Each of Kash Pandya, Bill Caplan and George Walker stepped down from the Board in 2012 but retained interests under Aggreko's LTIPs. Their 2010 LTIPs vested after their leaving the Board as follows: PSP CIP Shares Face value Shares Face value Total Former Directors Kash Pandya 24,408 436,659 22,388 400,521 837,180 Bill Caplan 22,724 406,532 16,530 295,722 702,254 George Walker 23,464 419,771 21,521 385,011 804,782 George Walker resigned from the Board on 31 December 2012, but continues to be employed by the Group as Group Marketing Director. No compensation for loss of office or other payment in connection with their redundancy was made during the year to Kash Pandya, Bill Caplan or George Walker. The Executive Directors are employed under contracts of employment with Aggreko plc. The Remuneration Committee sets notice periods for the Executive Directors at 12 months or less, which reduces the likelihood of having to pay excessive compensation in the event of poor performance. The principal terms of the Executive Directors' service contracts (which have no fixed term) are as follows: Notice period Executive Director Position Effective date of contract From Company From Director Rupert Soames* Chief Executive 1 July 2003 12 months 12 months Angus Cockburn Chief Financial Officer 1 May 2000 12 months 12 months Debajit Das Regional Director, Asia Pacific 1 January 2013 12 months 12 months Asterios Satrazemis Regional Director, Americas 1 January 2013 12 months 12 months David Taylor-Smith Regional Director, Europe, Middle East & Africa 11 March 2013 6 months increasing to 12 months after 12 months continuous service 6 months increasing to 12 months after 12 months continuous service * Rupert Soames resigned with effect from 24 April 2014. The Committee has a policy of encouraging Executive Directors to acquire and retain a material number of shares in the Company, with the objective of further aligning their long-term interests with those of other shareholders. Under this policy, Executive Directors should hold at least 50% of the net proceeds from any shares vesting until their aggregate shareholding is equivalent to at least the following proportions of their salaries: Chief Executive – 200%; Chief Financial Officer – 150%; and other Executive Directors – 100%. The Committee retains the discretion to grant dispensation from these requirements in exceptional circumstances. Current Executive Director shareholdings are included in the table in the following paragraph. Total shareholdings of Directors Director Shareholding requirement Shares held: owned Share interests held: Share interests held: subject Options held: Options held: subject to deferral Current shareholding (% salary)4 Guideline Rupert Soames 200 333,759 344,880* – 726 – 845 Yes Angus Cockburn 150 84,906 174,414 – 714 – 363 Yes Debajit Das 100 37,461 101,188 – – – 209 Yes Asterios Satrazemis 100 46,250 112,306 – 736 – 247 Yes David Taylor-Smith** 100 6,252 55,872 – 690 – 31 n/a Ken Hanna 20,188 David Hamill 3,875 Russell King 3,875 Diana Layfield*** – Robert MacLeod 19,525 Rebecca McDonald – Ian Marchant 3,500 1This includes shares held by connected persons. 2Shares held subject to performance comprise LTIP awards over shares. These are detailed in the Summary of Interests in the Group's LTIPS and Sharesave Plans table above. 3Options held under the Sharesave Scheme. 4Share price used 1709p as at 31 December 2013. Salaries paid in local currency have been converted as shown in Notes 3 and 4 to the table of salaries above. *Of these, interests representing 219,800 shares will lapse on 24 April 2014 upon Rupert Soames' resignation. **David Taylor-Smith was appointed to the Board on 11 March 2013. His first LTIP Award was granted in August 2013, therefore, under this policy he will then be required to hold at least 50% of the net proceeds from any shares vesting in August 2016. ***Diana Layfield purchased 3,000 shares on 3 January 2014. Rupert Soames, Angus Cockburn, Debajit Das, Asterios Satrazemis and David Taylor-Smith as employees of the Company, have an interest in the holdings of the Aggreko Employee Benefit Trust (the 'EBT') as potential beneficiaries. The EBT is a trust established to distribute shares to employees of the Company and its subsidiaries in satisfaction of awards granted under the Aggreko Share Performance Plan and Aggreko Co-investment Plan and Sharesave Schemes. At 31 December 2013, the trustees of the EBT held a total of 1,331,750 Aggreko plc ordinary shares (2012: 2,176,628) and the holding at the date of this report is 1,138,642. The dividend has been waived on these shares. The graph below shows Aggreko's profit after tax, dividend, and total employee pay expenditure for the financial years ended 31 December 2012 and 31 December 2013, and the percentage change. The graph overleaf shows the value, at 31 December 2013, of £100 invested in Aggreko's shares on 31 December 2008 compared with the current value of the same amount invested in the FTSE 100 Index. The FTSE 100 Index is chosen because Aggreko is a constituent member of this group. For comparative purposes, the pay of Rupert Soames, Chief Executive, for the same financial years is set out below: Year Single figure of Annual bonus payout Long term incentive 2009 2,555,850 63.2% 100% 2010 5,839,209 100% 100% 2011 8,501,865 82.4% 100% 2012 2,685,840 6.4% 100% 2013 1,787,849 49.6% 72.5% The data in this table was taken from the Remuneration Reports for the relevant years. The change in Chief Executive's remuneration from 2012 to 2013 in comparison to employees within the Group central functions is shown in the table below. Percentage change Percentage change of employees Salary/fees – 2 Benefits 7.5 7.8 Bonus 1,056 1,700 Total single figure (see table here) -33 n/a The total remuneration of the Chief Executive for 2013 was £1,787,849 which is 33% less than the previous year which is £2,685,840. The comparator group relates to the employees within the Group central functions in the UK (94 employees) rather than all Group employees. This group was used because the Committee believes it provides a sufficiently large comparator group to give a reasonable understanding of underlying increases, based on similar annual bonus performance measures utilised by Group central functions, whilst on the other hand reducing the distortion that would arise from including all of the many countries in which the Group operates, with their different economic conditions. The following table shows the results of the advisory vote on the 2012 Remuneration Report at the 25 April 2013 AGM. Total number of votes % of votes cast For 163,992,672 95.43% Against 7,855,097 4.57% Total votes cast (excluding withheld votes) 171,847,769 100% Votes withheld* 5,358,881 Total votes cast (including withheld votes) 177,206,650 * A withheld vote is not a vote in law and is not counted in the calculation of the proportion of votes cast for and against a resolution. The Committee intends to implement the Remuneration Policy in 2014 in line with its implementation in 2013, and more specifically as follows: Base salaries and fees Angus Cockburn was awarded a salary supplement of £200,000 with effect from 1 March 2014 to reflect the additional requirements resulting from his appointment as Interim Chief Executive. Pensions and benefits Annual bonus D-EPS Operating cashflow Regional trading profit Regional debtor days Total max bonus Max bonus On budget bonus Max bonus On budget bonus Max bonus On budget bonus Max bonus On budget bonus Angus Cockburn1 150 112.5 56.3 37.5 18.8 – – – – Angus Cockburn2 175 131 65.5 44 22 – – – – Debajit Das 100 50 25 – – 40 20 10 10 Asterios Satrazemis 100 50 25 – – 40 20 10 10 David Taylor-Smith 100 50 25 – – 40 20 10 10 1 During the period as Chief Financial Officer. 2 During the period as Interim Chief Executive (with effect from 1 March 2014). We have not disclosed the budget numbers in this report, as we consider them to be commercially sensitive. It is, however, our intention to disclose numbers based on Group performance in the 2014 Annual Report on Remuneration. Long-term Incentive Plan PSP CIP Executive Director Shares Face value % vesting Shares Face value % vesting Angus Cockburn 38,216 599,991 – 30,572 479,980 25 Debajit Das 27,778 436,115 – 22,224 348,917 25 Asterios Satrazemis 29,592 464,594 – 23,672 371,650 25 David Taylor-Smith 33,440 525,008 – 26,752 420,006 25 * The face value is calculated using the share price of 4 March 2013. The performance criteria for the 2014 LTIP are as follows: In addition to the above, and to reward truly exceptional performance, the number of shares awarded to participants in both elements of the 2014 LTIP may be increased by between 1 and 2 times if the real compound annual growth in D-EPS over the three-year performance measurement period is in a range of 10% to 20%. Awards are expected to be granted in April 2014. The Directors' Remuneration Report, including both the Policy and Annual Remuneration Report, has been approved by the Board on 6 March 2014. Russell King

The purpose of the Annual Bonus Scheme is to align Executive Directors with performance during the year, and to motivate them to meet and beat demanding annual performance targets.

(% salary)

% salary

% salary

% salary

% salary

% salary

% salary

% salary

% salary

(%

salary)

%

salary

adjusted

salary

%

salary

salary

% salary

salary

%

salary

salary

outcome

£

Executive Directors participate in pension schemes or receive cash in lieu with a value appropriate to themedian practice in their home countries.

The LTIP was first introduced in 2004, and each year senior executives are invited to join. It consists of two distinct elements: the Performance Share Plan (PSP) and the Co-investment Plan (CIP). 2010 LTIP awards

2011 LTIP awards

period ended

price on expected

date of vesting/market

price on date vested

2012 LTIP awards

Sharesave Plans

Non-executive Directors (including the Chairman)

SCHEME INTERESTS AWARDED IN 2013

2013 LTIP awards

During the year Asterios Satrazemis and David Taylor-Smith were also granted options under the Company's Sharesave Plans.

The table below shows details of interests awarded to Executive Directors under the LTIP and Sharesave during 2013:

£

on minimum performance

£

on minimum performance

£

on minimum performance

SUMMARY OF INTERESTS IN THE GROUP'S LTIPS AND SHARESAVE PLANS

during year

VESTING OF LTIP AWARDS TO FORMER DIRECTORS

£

£

£

DETAILS OF EXECUTIVE DIRECTORS' SERVICE CONTRACTS

SHARE OWNERSHIP GUIDELINES

DIRECTORS' SHAREHOLDINGS

As at 31 December 2013, the shareholdings of the Directors were as follows:

(% salary)

outright1

subject to performance2

to deferral

not subject to performance3

met?

RELATIVE IMPORTANCE OF SPEND ON PAY

COMPARISON OF COMPANY PERFORMANCE

total remuneration

£

against maximum

%

vesting rates against

maximum opportunity

%

PERCENTAGE CHANGE IN REMUNERATION OF THE CHIEF EXECUTIVE

of Chief Executive

STATEMENT OF SHAREHOLDER VOTING

IMPLEMENTATION OF REMUNERATION POLICY IN 2014

Base salaries for Executive Directors will be reviewed by the Committee in December 2014 and fees for Non-executive Directors will be reviewed by the Board in December 2014. The Chairman's fee will be reviewed by the Committee in April 2014.

Pensions and benefits will continue in line with policy.

On 3 March the Committee set annual bonus targets for the Executive Directors as follows:

(% salary)

% salary

% salary

% salary

% salary

% salary

% salary

% salary

% salary

The Committee has also approved the grant of 2014 LTIP awards as follows:

£*

on minimum performance

£*

on minimum performance

Chairman of the Remuneration Committee

6 March 2014